Making money online can be tough, but there are some pretty cool ways of making extra cash. Cashback and rewards sites are the latest in a long line of ways to boost your income through online shopping.

When it comes to shopping online, cashback and rewards seem similar. Both encourage you to shop and give you a little back. But are they the same thing?

I’ll explore the differences between cashback and rewards, and hopefully, by the end of this article, you’ll have a better idea if one is better than the other for you.

Why do companies give cashback or rewards anyway?

In today’s society, everyone is looking for the next better deal. Whether it is buying a new computer, registering for an online service, or simply purchasing a sweater that you saw in the store window.

Cashback and rewards are the newest and best way to provide those better deals; and where else may these offers be found?

When people buy goods or services online, they are usually drawn to a particular product or store because of the price and the features. But once they get there, what often keeps them from buying is the perception of how much effort it will all take.

Cashback and reward systems were developed by companies to help get people over that hurdle by making their customers feel as if they are getting something for nothing. And in doing so, a sale is more likely to be made. It’s a way of saying thank you for choosing our store, even though you didn’t have to.

What is cashback?

Cashback is a form of commission payment that you receive from retailers for engaging in certain online activities, such as clicking on their offers or viewing their websites. Cashback can be obtained from purchases under your chosen retailer.

Again, cashback is the price difference between what you pay for an item and how much cashback is received. In other words, you’re getting cash back instead of points.

If you are wondering what a cashback website is or thinking about whether to join Cashback, the answer is yes! I have made my findings and I have come up with the best cashback platforms for you to use. You should check it out.

What is the point of cashback?

It can sometimes feel like there are thousands of ways to earn something for the things you’re already doing every day. And that’s true. You can with cashback.

Cashback is a special offer from a retailer to give you money back on certain purchases. The exact way it works depends on the retailer and sometimes it’s not even needed as a discount code or anything.

The main point of cashback is to provide the shopper with an incentive for shopping, special offers that are difficult to refuse such as 3% off, 5%, 10%, and more dollars back on your shopping purchase.

What are reward points?

We all know rewards to be a gift or something given in return for services rendered. Some examples of rewards are money, points, badges, access to premium content, sponsored products/services, offers, and coupons.

Reward points are a form of loyalty currency. All reward programs can be simplified down to it being a simplified form of cashback. Reward points are a form of incentive to shop at certain stores.

That is, when you buy at a store that participates in the reward programs, you are allotted a certain number of points. The more points you have, the amount of money your purchase is worth, and the rewards program will pay that off to you (i.e. it’ll give you back the cash equivalent).

The points are accumulated and saved until you can redeem them for products or discounts on future purchases.

What is the reason behind reward points?

When you buy a product from an online store, you get reward points from the store to redeem against your next purchase. There are two reasons behind this practice – one is to encourage people to visit the store.

Another reason is that it makes shopping simple. When you can’t decide what items to buy, just browse through your reward catalog and use it to redeem any product of your liking.

Is cashback the same as reward points?

Cashback can be very different from reward points. They are often linked in that we are aiming to earn both when we purchase something, but it is not as straightforward as that.

They are fundamentally different in that cashback schemes require you to spend money to get cash, whereas reward points schemes require you to spend money to get nothing. Rewards systems are cashback in reverse.

Cashback rewards people with their own money back, and rewards systems give points that can be exchanged for cash at a time and place of the customer’s choosing.

You are not rewarded for spending by any definition of the term – it is an investment since you are exchanging your money for what may be nothing at all.

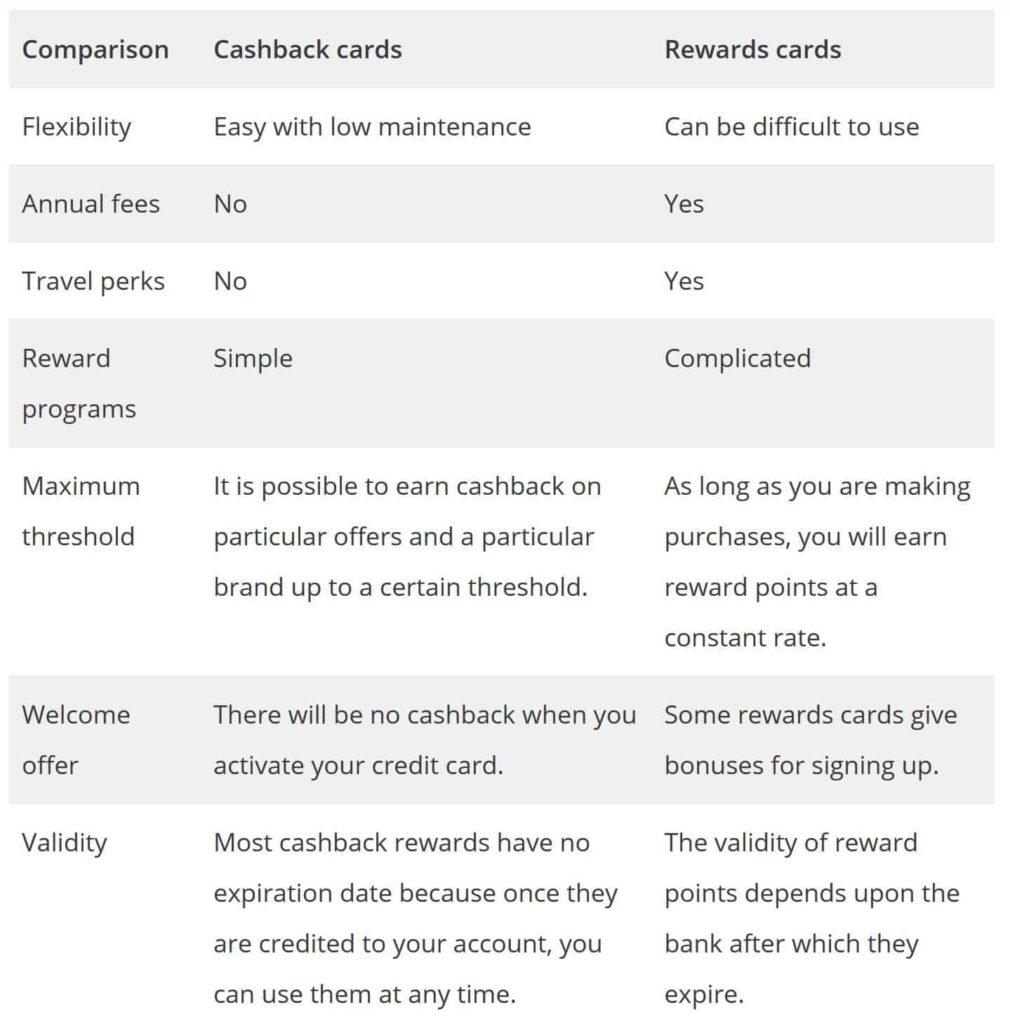

In addition, it is also different for their cards. A cashback card is a simple, flexible way to earn cash that you can use any way you want. On the other hand, reward cards enable you to redeem your rewards for different things like travel, thus providing you extra value.

What are cashback cards?

There is no way for me to talk about cashback and not talk about cashback credit cards.

Cashback credit cards are intended to give you a percentage of your spending in cash.

It works the same as a regular credit card, but you can always know that the money you spend will be returned to you in some way. Typically, using a cashback credit card will save you money compared to using another card without cashback benefits.

If you’re not earning cashback right now with your credit card, there’s no better time than the present to start!– why not give it a try?

What are reward points cards?

A reward credit card is a type of credit card that rewards you for making purchases with them. With a rewards card, you earn points for every dollar you spend. The number of points you get per dollar varies by the merchant and card, but in general, the more you buy from a vendor, the more points you will get.

Through these methods, consumers earn reward points that can later be redeemed for merchandise, gift cards, or travel. There are several reward credit cards out there that are worth giving a try.

Comparison of both cards

What is the link between cashback and reward points?

If you are a frequent shopper the link between cashback and reward points is that they essentially serve the same purpose. The link between cashback and reward points is pretty close.

The public generally does not realize that you can use both types of points at the same retailer, with a few exceptions. They also don’t know about the bonus opportunities that are enhanced when you combine them.

Cashback shopping is growing in popularity, so take some time to see how you can save even more money with cashback and earn extra points on top of what the store typically offers for purchases.

So, which of the two is better?

In terms of simplicity, cashback is the clear winner. You can choose the products you want to buy, find a retailer that pays you back for them and then buy them without worrying about anything.

Rewards points, which are earned with rewards programs like banks’ credit cards, are trickier to use: you have to think about how many points you need to collect to redeem them for something that you want.

As for actually having the points in your account – rewards programs usually require an upfront investment or involvement in their marketing plans so they’ll pay out eventually.

If you’re choosing a card, decide how you’re going to use it. You can go with a credit card with a high rewards rate assuming you don’t intend to carry a balance and interest rates don’t matter to you.

For frequent travelers, a reward card may be the best choice. Most frequent travelers take great pleasure in taking full advantage of travel-related perks and redeeming their loyalty points.

Choose a cashback card instead if you want a no-fee rewards card. Also, if you don’t travel often, you might benefit from a cashback card, which offers a straightforward rewards system.

Cashback can offer more benefits than rewards, so the best choice may be finding a card that offers both. Many credit cards let you redeem points for cash.

FAQs

How much money do you have to spend to make a cashback worthwhile?

Cashback offers are usually for a percentage of your spending, and you have to decide if the amount is worth the hassle.

There’s no fixed answer to this. Whenever a reward offers cashback, the amount can differ on an account-by-account basis.

With that said, those who spend big on Amazon purchases should have no problem making cashback work.

What’s the deal with cashback credit cards?

Cashback credit cards can be worthwhile if you use them wisely. They offer an easy way to save money on your everyday purchases and are among the best rewards cards out there. Cashback credit cards give you rewards in the form of cash.

Each time you make a purchase, a percentage of that amount is deposited back into your account as a reward. Using one requires a bit of discipline, though, since you’ll have to spend a little more and track all your spending regardless of whether you’re getting cashback or rewards.

Cashback ranges from 1 percent to 10 percent of each purchase, depending on the card. That’s one perk these cards have over traditional rewards cards: You know exactly how much you’ll earn every month.

How do I decide between cashback and rewards?

Both cashback and rewards offer great deals for consumers, so it can be difficult to decide between the two. There are pros and cons to each option, so it really comes down to your preferences.

To decide between cashback and rewards, think about how you like to spend: if you want to earn back the money you’re spending by using credit cards, cashback is for you.

If you’d rather get something back that you can put towards a purchase or trip, rewards points can be a good option.

Are cashback sites real?

Yes. In addition, cashback sites are completely free and legal. Some are better than others and your individual experience will depend on the site you choose, the category you select, and your level of expertise with shopping on the web.

Final thoughts

Are you struggling to decide between going for a cashback credit card or a rewards credit card? Or did you know that there are cards that combine both?

Cashback and rewards deals are often touted as excellent ways to finance your purchases, so it’s no surprise that it’s no longer just consumers who are interested in these offers. Companies are also keen to offer cashback deals for their products and end up saving a lot of money in the process.

Online shoppers face a dilemma when choosing between cashback and reward programs because they do not know which deal is better. This article will help you decide whether cashback or rewards should take center stage in your marketing strategy for earning something back from the purchases you make.